General

The Ultimate Guide to Income Tax Brackets (Easy to Understand)

Do you like to pick up an annual form and file your income tax yourself? There’s a lot of paperwork to figure out, but some of it has a standard breakdown.

Your tax return gets through the preparation process more accessible when you understand your tax bracket. You may have a basic understanding but need to learn the specifics.

How much you pay depends on your income. The United States has a progressive system with specific levels.

Income tax brackets identify how much you make. It’s a standard calculation that helps you figure out your liability.

The process is essential but needs clarification. To learn more, keep reading this article.

Comparing Tax Rates and Income Tax Brackets

Tax rates and income tax brackets are two related concepts people use to assess how much money individuals owe the government after taking out income taxes from their salary. They calculate rates as a percentage of a person’s taxable income. The exact rate is applied to all individuals regardless of income level.

By contrast, income tax brackets vary depending on how much someone earns. As a result, individuals who make more money generally fall into higher brackets and are charged higher taxes.

The tax rate does not increase along with the income tax brackets. Thus, two people in different frames may pay taxes at the same rate.

Determining Your Tax Liability

Determining your tax liability is essential to follow federal and state tax laws and regulations. You must collect all the necessary information influencing your income, such as wages and the following:

Capital Gains

They categorize capital gains as short-term or long-term. Short-term are items held for a greatest of a year. Long-term refers to items held for longer than a year before their sale.

Your tax rate on capital gains depends on the rate you apply to your ordinary taxable income. The higher your regular taxable income, the higher your capital gains tax rate. You may be exempt from paying on some or all your capital gains, depending on your situation.

Other Investment Income

You can compute your total investment income, which can come as interest or dividends, by adding up all amounts you earned during the tax year. Next, subtract any deductions applicable to the income, such as paid taxes or incurred losses. Finally, by consulting the relevant regulations, use this total to determine your liability.

Using up-to-date software, a calculator, or a preparer is advisable to file taxes and claim the appropriate conclusions. You should also be aware of tax litigation or changes affecting your liability. Knowing the answers to any more questions from the Internal Revenue Service (IRS) is also necessary.

Exploring Your Adjusted Gross Income

Your adjusted gross income (AGI) is the amount you earn a year before any taxes or deductions. You must understand this because various withholding may be eligible based on income.

They use your AGI to calculate federal income tax rates, credits, and other benefits and deductions. Knowing your AGI to calculate how much taxes you owe or how much you will receive in deductions or credits would be best. Then, you can use the information to decide which tax deductions or credits you should claim.

Compare your AGI to your prior year’s total and consider income and deductions from the past year. By doing so, you will understand your allowable deductions and credits and make sound financial decisions.

Claiming Tax Deductions and Credits

Claiming tax deductions and credits is a great way to reduce the taxes you pay each year. These deductions and credits can either be credits to offset current year taxes. They can also be deductions that reduce a taxpayer’s taxable income.

The type of deductions and credits available to individuals include deductions for:

Charitable Contributions

You can claim charitable contributions of money or goods as a deduction as long as receipts back them up. Your tax advisor can guide you through the reporting requirements. It would help if you itemize your contributions of goods to organizations such as Goodwill; there are limits to noncash donations.

Mortgage Interest

IRS allows you to deduct mortgage interest from your taxes each year. You can then take the deduction on the main house or one vacation home.

When filing taxes, the homeowner must itemize their deductions on the Schedule A form. The amount they may deduct equals the interest they paid during the year. Also, they are subject to some most considerable amounts specified by the IRS.

Medical Expenses

Some medical expenses that may be tax deductible include doctor’s visits and health insurance premiums. It may also include prescription medications and even long-term care expenses. While some costs may be deductible, there are specific thresholds you must meet to receive the total amount of deduction.

Childcare Expenses

You can claim childcare expenses for any child under 13 for whom the parent or guardian receives a dependent exemption. Generally, any out-of-pocket childcare expenses, such as daycare or after-school programs, are eligible. You may also claim costs paid to a household employee, although there may be extra considerations that you must take into account.

You can claim credits for dependent care, earned income, and education costs. But, keep good records and fulfill all requirements before taking any tax return deduction or credit.

Minimizing Your Tax Liability Through Rate Optimization

Rate optimization involves taking advantage of the different tax rates and deductions. You can maximize your tax benefits by paying attention to how and where you generate your income. For example, you can seek out capital gains instead of ordinary income, as the tax rate is generally lower.

You can also consider deductions for items you use for business, such as meals, travel, and supplies. Another way is to look at any retirement savings plans or investments and see if you are eligible for extra credit or deductions.

Paying attention to the amount of taxable income you are earning and where that income comes from can go a long way toward minimizing your tax liability.

The Impact of Your Filing Status

Tax filing status plays a vital role in the amount of taxes that individuals pay. The amount of the refund or tax bill depends on whether the taxpayer filed their taxes as follows:

Single

Single filing status has a range of implications when filing taxes. For example, single filers have limited eligibility for certain credits and deductions. This limit also comes with exemptions only applicable to married couples or joint filers.

Income thresholds for taxation are higher for them. In addition, single filers may face higher filing penalties, particularly if they fail to submit their returns promptly.

Married Filing Jointly

Filing married jointly has a few key advantages. First, the combined incomes of both spouses increase their chances of receiving larger tax refunds. The benefit is usually higher than if each individual filed separately.

Married couples who file joint returns are generally eligible for more tax credits and deductions. Also, since only one return is required, it is more convenient than filing separate returns.

Married Filing Separately

Married filing separately often suits married couples who need to file taxes separately. This filing status also fits those who will benefit financially from filing separately. It can provide several benefits, such as avoiding joint liability for a tax debt if there is an over-audit on one spouse.

But, this filing status is not eligible for certain credits and deductions, and you can’t enjoy the lower rate for married filing jointly. For example, couples cannot deduct home mortgage interest, a financial benefit for married couples.

Head of Household

Head of household offers more significant tax savings and potential eligibility for certain credits than single or married filing separate statuses. For example, filers can typically claim a higher standard deduction and a more comprehensive range of tax credits with this status.

On the downside, filers must support an actual dependent, and there are stringent requirements to meet. In addition, in the event of an IRS audit, the filer must provide evidence that they are fulfilling the head of household role and providing support for a dependent.

Qualified Widow

The impact of this status is twofold. Firstly, it can provide individuals with financial stability and security by allowing them to receive the same tax benefits that a married couple would receive. Secondly, this filing status allows individuals to remain financially independent and provide them with some closure after the death of their spouse.

You must use the best filing status and tax credits, depending on your situation. By doing this, you can ensure the lowest possible burden.

Consequences of Not Paying Your Taxable Income

Not paying your taxable income can have devastating financial effects. It may also leave negative personal and professional implications. You are committing tax evasion, which is a criminal offense that can have far-reaching consequences.

You may be subject to interest and penalties that the federal, state, or local governments assess upon failure to pay what you owe. In the most severe cases, they can imprison taxpayers for their offenses.

Some consequences include or affect the following:

Credit Score

IRS may garnish wages or file liens on the property until you pay the debt. When this happens, it creates an adverse payment history which negatively affects credit scores and creditworthiness. They may also collect on past-due balances through levies or by seizing bank accounts and other assets.

As a result, this makes it extremely difficult for an individual to get access to financing in the future. It will also make it harder to open a line of credit or obtain a loan.

Lose Passport

The IRS can now deny, revoke, or limit passports for taxpayers who owe taxes. So, for example, if one owes the IRS money and does not pay it on time, the IRS might take away the person’s passport – even if the person is making arrangements to pay the debt.

Furthermore, even if you pay off the debt, they could still decide to limit a person’s ability to travel internationally.

Lose Tax Refund

The IRS can take your refund to cover any unpaid taxes or penalties. But, even if you do not owe taxes, interest will accumulate at a specific rate of your monthly due until you pay them in full.

Additionally, you will have to pay the total amount you owe and interest. IRS can also levy a penalty for not filing your taxes on time.

Updates & Changes to the Tax System

Tax reform is a necessary part of the government’s yearly agenda. They have recently updated the tax system to ensure taxes are more fair and efficient.

These changes include but are not limited to an increased tax rate for high-income earners and an expanded child tax credit. It also modifies the creation of deductions for businesses investing in research and development.

Updates include incentives for businesses to hire and keep employees from disadvantaged populations. They have also modified the current tuition and fee deductions.

All these adjustments aim to create a more fair system for individuals and businesses. They are helping to raise tax revenue and provide opportunities for economic growth.

Utilizing a Tax Professional for Insight and Guidance

Tax professionals know tax laws and processes and can tell on maximizing returns and deductions. In addition, they can ensure that you complete all paperwork.

They can provide up-to-date information on changes and inform interested parties. They can also streamline the filing engagement and ensure you do it on time.

These professionals can help you tackle more complicated issues like self-employment taxes and recognize capital gains. If you need one, try the services from Tax Relief Professional. Check their website’s homepage for information.

Understand Your Liabilities and Rights as a Taxpayer

One can confidently prepare for filing and maximize their financial gain by understanding income tax brackets. In addition, this guide has helped to demystify the complexity and fear associated with filing taxes.

Now that you know the basics, it’s time to prepare to file yours. Take action today, and you’ll be well-positioned for tax season.

If you find this article helpful and informative, browse our other blogs for more exciting content!

General

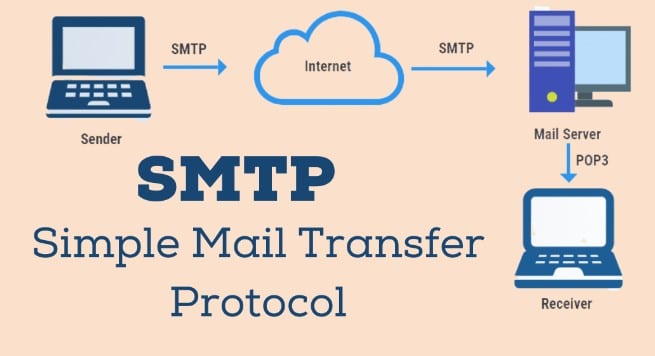

How to Send SMTP Email with Magento

Sending emails through SMTP (Simple Mail Transfer Protocol) in Magento 2 is crucial for ensuring reliable delivery of transactional and promotional emails to your customers. Magento 2, by default, sends emails using the PHP mail function, which may not always provide the highest level of email deliverability. Integrating SMTP into your Magento 2 setup allows you to use an external mail server, significantly improving email reliability and trustworthiness. Here’s how you can configure Magento 2 to send emails using SMTP, leveraging a custom SMTP extension or module for enhanced control and flexibility.

Step 1: Choose an SMTP Extension for Magento 2

To get started, you’ll need to choose a reliable SMTP extension for Magento 2. There are several high-quality SMTP extensions available in the Magento Marketplace. These extensions allow you to easily configure Magento 2 to send emails through virtually any external SMTP server, including popular services like Gmail, Amazon SES, SendGrid, and more.

Step 2: Install the SMTP Extension

Once you’ve selected an SMTP extension, the next step is installation. You can usually install an SMTP extension through Magento 2’s Web Setup Wizard or using the command line interface. Here’s a general outline of how to install it via command line:

- Backup your Magento 2 store before making changes.

- Download the extension package and unzip it into your Magento 2 root directory.

- Run the Magento setup upgrade command to install the extension:

php bin/magento setup:upgrade

- Deploy static content (if necessary) and clear the cache:

php bin/magento setup:static-content:deploy php bin/magento cache:clean

Step 3: Configure the SMTP Extension

After installation, log into your Magento 2 admin panel to configure the SMTP extension. The configuration process may vary slightly depending on the extension you choose, but generally, you will need to:

- Navigate to the extension’s settings page, often located under Stores > Configuration > Advanced > System > SMTP or a similar path.

- Enable the extension and enter the SMTP server details provided by your email service. This includes the SMTP server name, port, authentication method, username, and password.

- Choose the security protocol (SSL/TLS) as required by your SMTP server.

- Set the sender and reply-to email addresses for outgoing emails.

- Some extensions allow you to send a test email to verify the configuration. It’s highly recommended to use this feature to ensure everything is set up correctly.

Step 4: Test Email Functionality

After configuring the SMTP extension, it’s important to test the email functionality thoroughly. Place test orders, reset passwords, and perform other actions that trigger emails to ensure they are being sent and received as expected.

Step 5: Monitor Email Deliverability

Finally, monitor your email deliverability closely after switching to SMTP. Keep an eye on your email server’s logs, Magento’s email logs (if available through your extension), and any bounce messages. Adjust your SMTP settings as needed to ensure optimal deliverability.

Conclusion

Integrating SMTP into Magento 2 can dramatically improve your store’s email reliability and deliverability. By selecting a robust SMTP extension, configuring it with your preferred external SMTP server, and monitoring your email performance, you can ensure your customers consistently receive important communications from your store. This not only enhances the customer experience but also supports your store’s reputation and operational efficiency.

General

How To Transition Your Winter Wardrobe Into Spring

As the snow melts and the days grow longer, the transition from winter to spring wardrobe becomes an annual ritual for fashion-forward individuals, like people who shop at RW&CO. Moving away from heavy layers and dark tones to embrace the lightness and freshness of spring can be a rejuvenating experience. To ensure your closet is ready for the seasonal shift, thoughtful consideration is needed in selecting which items to keep at arm’s reach and which to store away. Below, you’ll find strategic tips and practical advice to transform your winter wardrobe into a springtime fashion statement.

Layering Techniques for Adapting Winter Items for Warmer Weather

Layering remains a staple technique as we oscillate between winter and spring. The key to mastering layering is selecting pieces that can be easily removed as temperatures rise throughout the day. A light cardigan or a denim jacket can be the perfect accompaniment to a spring dress or top.

Think about combining fabrics and textures in unique ways. A chunky knit sweater, for example, can be paired with a flowy floral skirt, striking the right balance between comfort and style. Layering also allows you to introduce vibrant spring patterns into your look gradually.

Reimagining your winter staples can also give them new life. A heavy sweater can be worn over the shoulders with a casual spring dress, combining warmth with a punch of style. Similarly, winter’s long-sleeve tops can be re-purposed underneath sleeveless dresses or vests.

Investing in transitional spring outerwear is a smart move as well. These items not only keep you warm during unpredictable spring weather but also add a layer of sophistication to your ensemble.

The Role of Color and Pattern in Spring Wardrobe Refresh

Spring fashion is synonymous with bright colors and playful patterns. To transition your wardrobe, start incorporating pastels and vibrant tones with accessories like belts and jewelry. Gradually introduce these pops of color to your daily outfits, signaling the seasonal change.

Patterns also play a pivotal role in springtime attire. Floral prints are a perennial favorite, offering a nod to the blossoming flora of the season. Stripes, too, can rejuvenate your look, adding visual interest and pairing well with solid colors.

The color palette of your wardrobe should reflect the lighter, more cheerful mood of spring. Consider swapping out darker hues for shades that mirror the blooming outdoors. A dusty rose blouse or a sky-blue sweater can change the tone of your outfit significantly.

Essential Spring Pieces To Integrate with Your Winter Staples

A few key pieces can serve as the cornerstone of your spring wardrobe. Lightweight blazers and tailored trousers can provide structure and style, while still allowing for layering on chillier days. Integrating these with thicker winter items can create harmonious outfits suited for spring’s unpredictability.

Spring is also the time to embrace lighter, breathable fabrics like cotton and linen. These materials are not only comfortable but also have the added benefit of transitioning well from day to night. Try pairing a light linen shirt with a winter wool skirt for an outfit that deftly bridges the seasonal divide.

Dresses and skirts rise to prominence in spring fashion. Midi and maxi lengths provide the right amount of coverage for early spring while hinting at the warmer days ahead. These can be worn with winter boots at first, transitioning to open-toed footwear as the weather permits.

Overall, transitioning your wardrobe from winter to spring is about blending practicality with a splash of seasonal freshness. By layering wisely, introducing vibrant colors and patterns, and integrating a few essential spring pieces, you can create a wardrobe that’s both stylish and functional.

General

Unlocking the Mystery of 2131953663

In today’s digital age, where communication is at the heart of our daily interactions, phone numbers play a crucial role in connecting people and businesses. One such number, 2131953663, is a landline number operated by the esteemed telecommunications company, Pacific Bell. Let’s delve into the significance of this number and the services it represents.

Understanding 2131953663

Company Background: Pacific Bell

Pacific Bell, a subsidiary of AT&T, has been a prominent player in the telecommunications industry for decades. Known for its reliable services and extensive network coverage, Pacific Bell serves customers across various regions, including the United States.

Area of Operation

While Pacific Bell primarily operates in the western United States, its services extend beyond geographical boundaries, catering to a diverse customer base with varying communication needs.

History of Pacific Bell

Origins and Evolution

Founded in the late 19th century, Pacific Bell has witnessed the evolution of telecommunications, adapting to technological advancements and changing consumer preferences over the years.

Major Milestones

From laying the groundwork for telephone infrastructure to pioneering digital communication technologies, Pacific Bell has achieved numerous milestones, shaping the landscape of modern telecommunications.

Overview of Landline Phones

Importance in Modern Communication

Despite the rise of mobile and internet-based communication platforms, landline phones remain a staple in many households and businesses, offering reliability and clarity of voice communication.

Decline in Usage

While landline phones have seen a decline in usage, particularly among younger generations, they continue to serve specific purposes, such as providing a reliable backup during emergencies and maintaining a dedicated business line.

How Phone Numbers are Assigned

Structure and Format

Phone numbers, including 2131953663, follow a standardized format, comprising an area code, prefix, and line number, facilitating efficient routing of calls within the telecommunications network.

Allocation Process

Telecommunications regulatory bodies oversee the allocation of phone numbers, ensuring fair distribution and adherence to industry standards to avoid conflicts and overlaps.

The Significance of 2131953663

Geographic Relevance

2131953663 holds significance within its designated geographic area, serving as a point of contact for individuals and businesses seeking reliable communication services.

Potential Services Offered

From residential landline connections to business solutions, 2131953663 represents a gateway to a wide range of telecommunications services offered by Pacific Bell, tailored to meet diverse customer needs.

Why Choose Pacific Bell

Reputation and Reliability

Pacific Bell’s longstanding reputation for reliability and customer satisfaction makes it a preferred choice for those seeking dependable communication services.

Service Offerings

With a comprehensive suite of services, including voice, data, and internet solutions, Pacific Bell caters to both residential and business customers, ensuring seamless connectivity and communication.

Comparing Landline and Mobile Services

Pros and Cons

While mobile phones offer mobility and convenience, landline phones boast superior call quality and reliability, making them suitable for specific use cases, such as home and office environments.

Suitability for Different Needs

The choice between landline and mobile services depends on individual preferences, lifestyle factors, and the nature of communication requirements, with each offering distinct advantages and limitations.

Evolving Trends in Telecommunications

Impact of Technology

Advancements in technology, such as Voice over Internet Protocol (VoIP) and mobile apps, have transformed the telecommunications landscape, offering new avenues for communication and collaboration.

Future Predictions

As technology continues to evolve, the future of telecommunications holds promise for enhanced connectivity, personalized services, and innovative solutions to meet the evolving needs of consumers and businesses alike.

Regulatory Framework for Phone Numbers

FCC Regulations

The Federal Communications Commission (FCC) oversees regulations pertaining to phone numbers, ensuring fair practices, consumer protection, and compliance with industry standards.

Compliance Requirements

Telecommunications providers, including Pacific Bell, must adhere to regulatory requirements regarding the allocation, usage, and management of phone numbers, maintaining transparency and accountability.

Consumer Perspectives

Reviews and Testimonials

Customer feedback and testimonials provide valuable insights into the quality of services offered by Pacific Bell, helping prospective customers make informed decisions based on real-world experiences.

Customer Satisfaction

Pacific Bell’s commitment to customer satisfaction is reflected in its efforts to address concerns, resolve issues promptly, and continuously improve service quality to meet or exceed customer expectations.

Common Misconceptions about Landline Phones

Myths vs. Reality

Despite the prevalence of mobile and internet-based communication, landline phones continue to face misconceptions regarding their relevance and utility, often overshadowing their inherent benefits and reliability.

Debunking Misconceptions

By debunking common myths surrounding landline phones and highlighting their unique advantages, Pacific Bell aims to educate consumers and promote a better understanding of the role they play in modern communication.

Making the Most of Your Phone Number

Additional Services

In addition to basic voice communication, Pacific Bell offers a range of supplementary services, such as caller ID, voicemail, and call forwarding, empowering customers to customize their communication experience.

Customization Options

Customers can personalize their phone number and service plan to suit their preferences, whether they require a single line for residential use or a comprehensive package for business communication needs.

Conclusion

Exploring the enigmatic number 2131953663 has provided valuable insights into the world of telecommunications and the role played by Pacific Bell. Through its rich history, reliable services, and commitment to customer satisfaction, Pacific Bell continues to be a trusted provider in an ever-evolving industry. While the landscape of communication may change with advancing technology, the significance of phone numbers, like 2131953663, remains steadfast. As we navigate the complexities of modern communication, let us not overlook the enduring reliability and importance of landline phones and the services they facilitate.

-

Technology11 months ago

IGANONY – The Instagram Story Viewer That Will Change Your Life

-

Entertainment2 years ago

Solazola: Biography, Early life, Boyfriend and Nethwoth

-

Technology1 year ago

Clevo Nh70: A Powerful Gaming Laptop For Modern Era

-

News & Law1 year ago

Trusted Legal Help: 8 Things to Look for When Hiring a Lawyer

-

Health2 years ago

Velovita Snaps: The Weight Lose Solution You’ve Been Waiting For

-

Entertainment2 years ago

Bubblebratz: A Quick Biography